Articles

Such conditions shorter otherwise eliminated the new Personal Defense benefits for over step 3.2 million individuals who discovered a pension centered on work you to was not protected by Personal Shelter (a “non-protected your retirement”) as they didn’t shell out Societal Protection taxation. For this season, the best-getting Public Shelter beneficiaries are able to see costs from 4,873 whenever they retired in the many years 70. Package a few cuatropercent brings up over 2 yrs, with increased pros, along with an excellent longevity escalator, which have automatic increases and you can compounding of all the existing toughness tips. For the first time ever, firefighter toughness shell out increases and you may material in one percent rate because the all of the coming feet paycheck increases.

Search Banking companies / Credit Unions / Articles

The brand new UFA effectively contributed the fight to possess improved pensions away from widows and you will resigned males. An excellent twenty-eight-date vacation to own firefighters is actually based and various pension improvements ran to the impression. So it panel set written assistance for use of your own money, and therefore sends Uniformed UFA participants to IAFF affiliate LODD firefighter funerals around the united states and you can Canada.

More resources for nontaxable and you can excused purchases, you can also check out the California Service out of Taxation and you can Fee Management’s website at the cdtfa.ca.gov. If you were a citizen of California and you can paid back book for the property inside the California which had been your dominant residence, you may also be eligible for a cards that can be used in order to lower your income tax. Respond to all the questions on the “Nonrefundable Occupant’s Borrowing from the bank Qualification Number” included in this booklet to see if your qualify. Generally, federal Form W-dos, package 1 and you may package 16 is always to secure the exact same amounts. If they’re additional because you got income from a source additional Ca, you can’t file Function 540 2EZ.

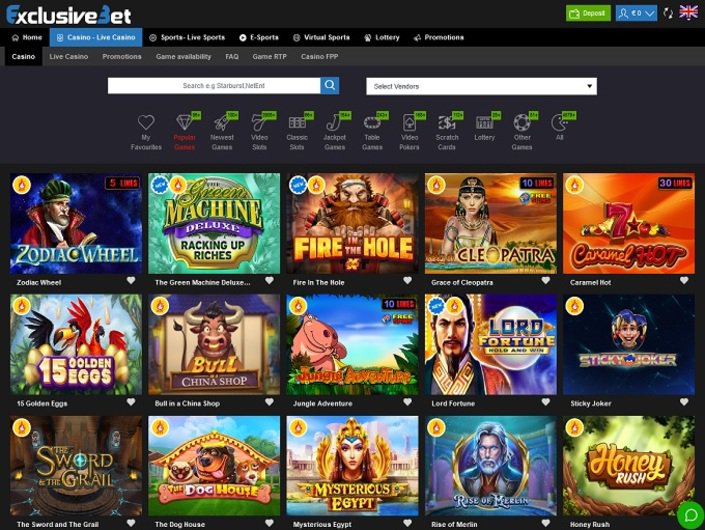

The new finances indicates expands away from 22 million and fifty million to possess Interior and you can USDA correspondingly to renovate and create housing to own team. This has been estimated you to as many as five hundred senior-top firefighters in the Forest Provider prevent using or don’t consult pay for times spent some time working after they reach the cap. Beneficiaries should also hold back until just after getting their April payment just before contacting SSA to inquire about the month-to-month work with matter while the the brand new number won’t be shown up until April due to their March commission. We desire beneficiaries to go to until April to inquire of the new status of their retroactive fee, because these payments usually procedure incrementally during the February. Extremely influenced beneficiaries begins acquiring their brand new monthly work for number within the April 2025 (for their March 2025 work for). There are other profitable combos on the Fire fighters Position video game than just various other online slots as it provides over a hundred 2-3-icon organizations.

Look at otherwise Currency Purchase

The list boasts half dozen borrowing from the bank unions merging because of worst monetary status as well as 2 for terrible management. Within the a study wrote inside the November, the brand new Congressional Research Provider projected one, as of December 2023, 745,679 Societal Protection beneficiaries—regarding the 1 percent of all beneficiaries—got their pros shorter by the GPO. As of an identical week, from the dos.1 million somebody, or about step 3 percent of all of the Social Protection beneficiaries, had been impacted by the brand new WEP. Democrats staved out of the rules bikers you to definitely Republicans looked for to include in the package. Such, it beat straight back an effort to help you block the newest regulations one to build access to the fresh abortion pill mifepristone. These people were as well as capable completely finance a nutrients program to own low-earnings girls, kids and kids, bringing in the 7 billion for what is called the newest WIC program.

To find out more, find particular range tips for Function 540, range 91. To help you claim the fresh based exclusion borrowing from the bank, taxpayers complete function FTB 3568, mount the design and needed files on the income tax come back, and you may create “zero id” regarding the SSN realm of line 8, Dependents, to the Setting 540 2EZ. Ca requires taxpayers https://vogueplay.com/ca/playfrank-casino-review/ just who play with lead from home filing reputation to document function FTB 3532, Lead from Family Processing Reputation Agenda, in order to declaration the direct out of house filing reputation try determined. If you don’t attach a finished form FTB 3532 to your tax return, we are going to reject your face from Home filing status. To learn more about the Lead of Home processing conditions, see ftb.ca.gov and appearance to own hoh.

- Do not document an amended Income tax Come back to update the fresh fool around with tax previously claimed.

- While the 2001, AFG provides assisted firefighters or any other first responders get critically necessary resources necessary for securing the general public and you will emergency team of fire and you may relevant hazards.

- Faithful solely to our Flame Family, we remind you to sign up today.

Make sure the label put you choose is offered by the an enthusiastic authorised deposit-taking establishment (ADI). Simply dumps with your organization (around 250k for each and every customer for each and every vendor) is actually guaranteed because of the Australian Bodies’s Economic Claim Strategy. Immediately after assessment the bonus with this checklist, it wound up while the our favorite 100+ no-deposit extra. We played with the newest 100 percent free processor chip and you can have been fortunate enough to help you cash-out 50 after satisfying the brand new betting requirements. I invested the cash to play 7 Stud Poker and Aces & Eights, a couple video game with 97percent+ come back prices.

Range 32 – Overpaid Income tax

Also, you’ll must dictate the best proportions in order to efficiency the brand new level of strength you require. I happened to be able to utilize it using my ice box and might opportunity all else which i required. Which have 1200 watts, it does usually force a couple smaller than average typical-measurements of hosts, in addition to admirers, tvs, and you will lighting.

State Handicap Insurance coverage – To own nonexempt ages beginning to your otherwise immediately after January step one, 2024, California takes away the brand new taxable wage restriction and you will restrict withholdings for each and every staff subject to County Disability Insurance (SDI) efforts. All of the wages is actually nonexempt for the purpose of calculating SDI worker efforts. Refunds of joint tax statements can be applied to the brand new costs of your taxpayer or spouse/RDP. Anyway taxation liabilities try paid off, any left credit will be placed on requested volunteer contributions, or no, as well as the others would be reimbursed. Particular taxpayers have to report organization requests subject to have fun with taxation right to the brand new California Company out of Income tax and you may Percentage Management.

When you yourself have more than one federal Setting W-2, create the numbers shown inside the container 17. When you have one or more government Form 1099-Roentgen, put all of the quantity shown within the box 14. The new FTB verifies the withholding claimed out of government Models W-2 or 1099-R to the Work Advancement Service (EDD).

Range step one as a result of Line 5 – Filing Position

If you entered on the an exact same-sex matrimony, your filing reputation for California create basically be the same as the new processing reputation that was useful for government. For those who and your spouse/RDP paid joint projected taxes but they are today filing separate income tax statements, both people get claim the entire count repaid, otherwise for every get claim an element of the shared projected taxation money. If you need the fresh projected tax payments becoming separated, alert the brand new FTB before you could document the new tax returns and so the repayments is applicable to your right account. The new FTB will accept on paper, any divorce contract (otherwise court-purchased settlement) or an announcement appearing the brand new allocation of the costs and a good notarized trademark from both taxpayers. If you inserted to your a same-intercourse relationship the submitting position to own California create basically function as the same as the fresh filing condition which had been used for federal.

You should check out the relevant revelation statements and other provide files prior to making a choice regarding the a credit device and you may look for separate economic advice. Whilst Currency.com.au endeavours to ensure the precision of your guidance considering to the this website, no obligations try recognized by the us the errors, omissions otherwise people wrong information regarding this amazing site. He’s computed to help individuals and you can organizations shell out as low as simple for lending products, due to training and you can strengthening world-class technology. There may additionally be genuine investment points (elizabeth.g. managed money) that seem just like what a phrase deposit also provides, however these are much higher risk, ASIC warns. It’s also wise to make sure that the item you’re also investing is really an expression deposit. The new Australian Ties and you may Investments Fee (ASIC) alerts that we now have instances when scammers advertise phony investment as the getting ‘including a phrase deposit’ which have ‘guaranteed high output’.

If you had no federal filing demands, make use of the same filing status to possess Ca that you will features familiar with file a national income tax go back. California laws conforms to help you federal laws that enables mothers’ election to statement a young child’s focus and you can bonus earnings away from a child under ages 19 or a full-go out college student below decades twenty-four for the mother or father’s taxation get back. See the guidance lower than as well as the tips to have Range 26 from your income income tax come back.